Buying prescription medications from overseas used to be one of the simplest ways to save money-especially for people on fixed incomes or without insurance. But as of August 29, 2025, everything changed. The U.S. government eliminated the $800 de minimis threshold that let small packages slip through customs duty-free. Now, even a $50 bottle of insulin from Canada or a $30 pack of metformin from India could face a $80 to $200 duty charge. If you’re still considering international mail-order for meds, you need to know exactly how the new rules work-or risk having your package seized, fined, or worse.

What Changed in August 2025

Before August 29, 2025, nearly every small package under $800 entered the U.S. without paying any duty. That included 97% of all international mail-order shipments. Most people didn’t even think about customs-they just clicked "buy" and waited for the box to arrive. But that’s over. Executive Order 14324, signed by President Trump in July 2025, ended the $800 exemption for all countries. Now, only purely personal gifts under $100 are still duty-free. If you’re buying medication for yourself, even if it’s just one prescription, the government now treats it as a commercial shipment.This isn’t just a tax hike-it’s a system overhaul. The U.S. Customs and Border Protection (CBP) now requires every international shipment to pay duties using one of two methods:

- Method 1 (Ad Valorem): You pay a percentage of the item’s declared value, based on the International Emergency Economic Powers Act (IEEPA) tariff rate. For most medications, this is between 2.5% and 5%.

- Method 2 (Flat Rate): A fixed fee based on the country of origin: $80 for countries with low tariff rates, $160 for medium, and $200 for high. This applies until February 28, 2026.

Here’s the catch: if you’re buying a $120 bottle of lisinopril from India, Method 1 might cost you $6. But Method 2? $80. That’s more than half the price of the drug. Many people are now realizing their "savings" vanished the moment the package hit customs.

Why Your Package Might Get Seized

It’s not just about paying duties. The U.S. Food and Drug Administration (FDA) still bans the import of most prescription drugs from foreign pharmacies unless they’re for personal use and meet strict criteria. Even if you pay the duty, your meds can still be stopped if:- The drug isn’t FDA-approved in the U.S. (most foreign versions aren’t)

- You’re ordering more than a 90-day supply

- The seller doesn’t require a valid prescription

- The packaging lacks proper labeling in English

CBP and FDA work together. In 2024, over 12,000 international medication shipments were seized at U.S. ports. Many were counterfeit pills-fentanyl-laced fake Adderall, expired insulin, or fake Viagra. Even if you think you’re buying from a "reputable" site, you have no way to verify the source. The FDA doesn’t regulate foreign pharmacies. A website that looks professional might be a scam operating out of a basement.

How to Legally Order Medications Overseas

There are legal ways to get medications from abroad-but they’re narrow and require effort. Here’s how to do it right:- Only buy from countries with FDA-recognized standards. Canada, the U.K., Australia, New Zealand, and the European Union have regulatory systems similar to the U.S. Avoid pharmacies based in India, Bangladesh, Pakistan, or Russia unless you can prove they’re licensed and inspected by a trusted authority.

- Require a valid U.S. prescription. The FDA allows personal importation of non-FDA-approved drugs if you have a prescription from a licensed U.S. doctor. Print it out. Keep a copy. Send it with the package.

- Order no more than a 3-month supply. Anything more will trigger automatic scrutiny. CBP considers bulk orders as commercial intent.

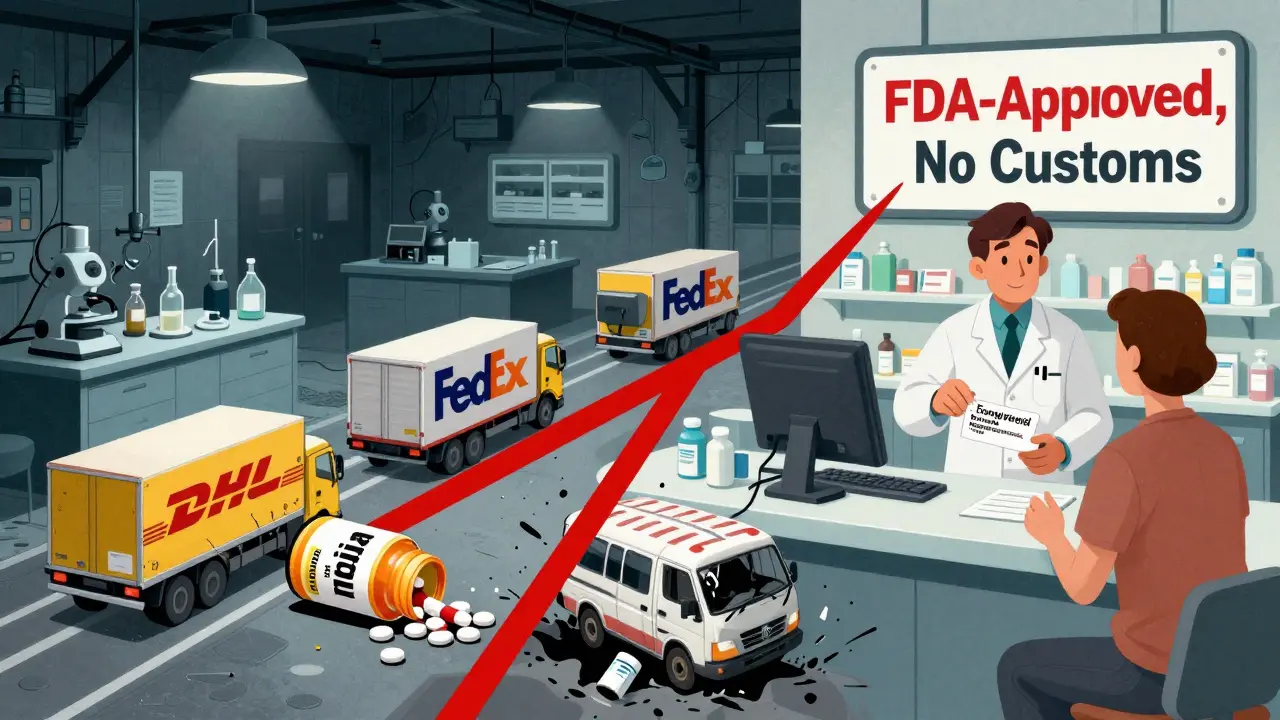

- Use a carrier that handles customs. Don’t use standard postal services. Deutsche Post, Canada Post, and many others stopped accepting business parcels to the U.S. after August 22, 2025. Use DHL Express, FedEx, or UPS-they have customs brokers built in. They’ll calculate duties upfront and bill you directly.

- Declare the correct HS code. Starting September 1, 2025, all commercial shipments need a six-digit Harmonized System code. For medications, it’s usually 3004.90 (other medicaments). Get it wrong, and you could be charged 300% more in duties.

Pro tip: If you’re buying insulin, metformin, or other high-cost meds, compare prices in Canada. Many U.S. pharmacies now partner with Canadian wholesalers. You can order through a U.S.-based pharmacy that sources from Canada, and they handle all the customs paperwork. It’s still cheaper than paying full price at CVS.

Who Pays the Duty? (And How to Avoid Getting Blamed)

One of the biggest sources of confusion? Who pays the duty. Is it the seller? The carrier? You? The answer: it’s you. If the package arrives and the duty hasn’t been paid, CBP will send you a notice. You have 30 days to pay-or the package is destroyed. There’s no appeal. No second chance.Some sellers offer DDP (Delivered Duty Paid) shipping. That means they’ve already paid the duty and taxes. Look for that option at checkout. If it’s not listed, assume you’re on the hook. Never click "I accept all customs charges" without knowing the exact amount.

Keep records. Save every invoice, tracking number, and customs notice. If your package is seized, you’ll need proof you tried to comply. Without it, you’ll lose the money and the meds.

What Happens If You Get Caught

Most people think they’ll just get a warning. That’s not true. CBP can:- Seize your medication with no refund

- Issue a civil penalty up to $100,000 per violation

- Block future shipments from that sender

- Report you to the FDA for potential criminal investigation

There’s no "first offense" exception. In 2024, over 300 people received formal penalty notices for importing unapproved drugs-even if they were just trying to save money on insulin. One man in Ohio was fined $50,000 after importing $2,000 worth of diabetes meds from Mexico. He didn’t know the rules. He still paid.

Alternatives to International Mail-Order

If the risks and costs are too high, here are better options:- Use U.S. pharmacy discount programs. GoodRx, SingleCare, and RxSaver often offer prices lower than international pharmacies-even after shipping and duties.

- Ask your doctor about generic equivalents. Many brand-name drugs have generics that cost 80% less. A $400 monthly prescription might drop to $30.

- Apply for patient assistance programs. Most major drug manufacturers (Pfizer, Merck, Novo Nordisk) offer free or low-cost meds to low-income patients. You can apply online in minutes.

- Consider Canadian online pharmacies with U.S. fulfillment. Companies like CanadaDrugs.com and HealthWarehouse.com have U.S. warehouses. You order from them, they ship from within the U.S. No customs, no duties, no risk.

One woman in Texas saved $1,800 a year by switching her insulin from a U.S. pharmacy to a Canadian-based U.S. warehouse. She pays $130 per month instead of $280. No customs forms. No tracking delays. No fear of seizure.

Final Advice: Is It Worth It?

The truth? For most people, international mail-order for medications is no longer worth the risk. The cost savings have vanished. The legal risks have exploded. The chance of getting counterfeit or expired drugs is real.If you’re still thinking about it, ask yourself:

- Am I buying from a licensed pharmacy with a physical address and phone number?

- Do I have a valid U.S. prescription?

- Am I ordering less than a 90-day supply?

- Have I confirmed the HS code and duty amount before paying?

- Am I using a carrier that handles customs (DHL, FedEx, UPS)?

If you answered "no" to any of these, don’t send it. The cost of a single seized package isn’t just the money-it’s your health, your time, and your peace of mind.

There are safer, simpler, and cheaper ways to afford your meds. Use them.

Can I still order medications from Canada legally in 2025?

Yes, but only under strict conditions. You must have a valid U.S. prescription, order no more than a 90-day supply, and use a carrier like DHL or FedEx that handles customs clearance. The medication must be for personal use only. Canada is one of the few countries with a regulatory system the FDA recognizes, so shipments from licensed Canadian pharmacies are less likely to be seized-if all rules are followed.

What if I buy from a pharmacy in India or Mexico?

It’s risky and often illegal. The FDA does not recognize most Indian or Mexican pharmacies as safe or legitimate. Even if you pay the duty, your package can still be seized. Many of these sites sell counterfeit or substandard drugs. In 2024, 78% of seized international medication shipments came from these regions. The risk of getting fake insulin, expired antibiotics, or pills laced with fentanyl is extremely high.

Do I need to declare my medication on the customs form?

Yes, and you must be specific. Don’t write "gift," "sample," or "health product." Write the exact name of the medication, the dosage, the quantity, and the manufacturer. Use the correct HS code (usually 3004.90). If you’re unsure, ask the seller for the correct declaration. Incorrect labeling is one of the top reasons packages are held or destroyed.

Why did my package get returned even though I paid the duty?

Because paying the duty doesn’t mean the FDA approves the drug. If the medication isn’t FDA-approved, lacks proper labeling, or was ordered without a prescription, it will be returned or destroyed-even if you paid every fee. Customs handles duties; the FDA handles safety. You need both to get your meds.

Is there a way to avoid paying high duties on medications?

Only if you use DDP (Delivered Duty Paid) shipping or buy through a U.S.-based pharmacy that sources from abroad. Some U.S. pharmacies partner with Canadian or European suppliers and handle all customs and duties for you. This is the safest and most cost-effective way. Avoid direct international shipping unless you’re prepared for the paperwork, delays, and risk.

Liz MENDOZA

December 27, 2025 AT 22:38I’ve been buying my insulin from Canada for years-never had an issue until this year. Now I’m stuck paying $120 in duties on a $90 bottle. It’s insane. I’m not rich, I’m just trying to stay alive. I wish there was a better way.

Anna Weitz

December 28, 2025 AT 08:09They’re not trying to stop you from saving money they’re trying to stop you from surviving. This is corporate policy dressed up as national security. The FDA doesn’t care if you die of diabetes they care if their monopoly gets cracked. Wake up.

Caitlin Foster

December 28, 2025 AT 22:47OMG I just got my package seized yesterday!! I paid $180 for metformin from India and now I’m out $260 total?? They sent me a letter saying ‘unapproved drug’ like I’m smuggling heroin?? I’m crying in my car right now.

Todd Scott

December 30, 2025 AT 06:33As someone who’s worked in global pharmaceutical logistics for 18 years, let me clarify something: the HS code 3004.90 is correct for most oral medications, but if you’re shipping insulin pens or injectables, it’s 3005.10. Many people get tripped up because they assume all meds are the same. Also-DHL and FedEx don’t ‘handle’ customs for you, they just bill you. You still have to declare accurately. And yes, Canada is the only safe foreign source if you’re not using a U.S.-based partner pharmacy. The rest? Gambling with your life.

dean du plessis

December 30, 2025 AT 14:13man i just ordered some pills from a site that looked legit and now i dont know if i should even open the box. i dont want to get fined but i also need these. life is weird sometimes

Kylie Robson

December 31, 2025 AT 18:44Per 19 CFR 141.102(b), the de minimis threshold was never a right-it was a temporary administrative exemption under 19 U.S.C. § 1321. Its removal was codified under the Trade Facilitation and Trade Enforcement Act of 2016, reactivated via EO 14324 under IEEPA authority. The flat-rate duty structure is a transitional measure under 19 CFR 141.103(a)(3), expiring 2026. You’re not being taxed-you’re being subjected to statutory importation compliance. If you lack a U.S. DEA-licensed prescriber or a valid NDC, your shipment is non-compliant regardless of payment.

Nikki Thames

January 2, 2026 AT 17:50You think this is about money? No. This is about control. The pharmaceutical-industrial complex doesn’t want you to know you can get life-saving drugs for 1/10th the price. They need you dependent. They need you scared. They need you paying $1,200 for insulin while billionaires buy private islands. This isn’t policy-it’s predation. And they’ve weaponized bureaucracy to make you feel guilty for wanting to live.

Paula Alencar

January 3, 2026 AT 15:39As a retired nurse who has watched patients ration insulin for decades, I find this entire regulatory shift morally repugnant. The government claims to protect public health, yet it has created a system where the most vulnerable are penalized for seeking affordable care. We have a moral obligation to provide access-not to punish compassion with customs forms. I urge every reader: if you can, advocate for legislation that reinstates safe, regulated international access. This is not a loophole-it is a lifeline.

Kishor Raibole

January 4, 2026 AT 17:03While I acknowledge the author’s meticulous enumeration of procedural requisites, I must respectfully contend that the underlying premise-that compliance with bureaucratic formalities constitutes ethical or medical legitimacy-is fundamentally flawed. The state’s assertion of jurisdiction over the procurement of essential therapeutics by private individuals constitutes an egregious overreach of sovereign authority. One does not require permission from a customs agent to sustain life. The real violation lies not in the shipment, but in the system that commodifies survival.

Janice Holmes

January 6, 2026 AT 02:05THIS IS A TRAP. I KNOW WHAT THEY’RE DOING. THEY’RE USING THE INSULIN CRISIS TO JUSTIFY FULL-SCALE DIGITAL TRACKING OF EVERY MEDICATION YOU TAKE. THEY’RE COLLECTING YOUR PRESCRIPTIONS, YOUR SHIPPING ADDRESSES, YOUR PAYMENT INFO-AND THEY’RE BUILDING A NATIONAL PHARMACEUTICAL DATABASE. NEXT THEY’LL USE AI TO DENY YOU MEDS BASED ON YOUR CREDIT SCORE OR SOCIAL MEDIA POSTS. THIS ISN’T ABOUT TAXES-IT’S ABOUT CONTROL. THEY WANT YOU TO BE DEPENDENT ON THE SYSTEM. DON’T FALL FOR IT.

Andrew Gurung

January 6, 2026 AT 10:09Anyone who still buys from India or Mexico is either naive or suicidal. I’ve seen the FDA seizure reports. 78% of those packages contain fentanyl or rat poison disguised as pills. You think you’re saving money? You’re paying with your kidneys, your liver, your brain. This isn’t capitalism-it’s Russian roulette with your life. If you’re not using a licensed Canadian partner or a U.S. pharmacy with verified sourcing, you’re not a patient-you’re a statistic waiting to happen.

Liz MENDOZA

January 7, 2026 AT 21:57Thank you for sharing this. I’ve been so scared to speak up. I just want to live. I’m going to try the Canadian U.S.-based warehouse route. If anyone knows a good one, please DM me. You’re not alone.