When you walk up to the pharmacy counter with a prescription in hand, you expect to pay what your doctor told you. But then the pharmacist says, "That’s $420 today," and you freeze. You didn’t sign up for this. You’re not rich. You’re just trying to stay healthy. This isn’t rare. In the U.S., nearly one in four adults skip doses or split pills because they can’t afford their meds. The real question isn’t whether your drug works-it’s whether you can actually get it without going into debt.

Why Your Prescription Costs So Much

The price tag on your pill bottle doesn’t come from nowhere. It’s built by layers of middlemen, hidden deals, and profit margins that have nothing to do with how much it costs to make the drug. A bottle of insulin might cost $10 to produce but sell for $300. Why? Because the system rewards complexity, not fairness. Pharmaceutical companies set a list price. Then Pharmacy Benefit Managers (PBMs)-the middlemen between insurers and pharmacies-negotiate rebates behind closed doors. You never see those rebates. Instead, you pay the full list price at the counter, unless you have insurance that covers part of it. And even then, your copay can still be sky-high because insurers use “formularies” that push you toward pricier drugs if they get a bigger kickback from the maker. The Inflation Reduction Act of 2022 changed some of this-for Medicare patients. Starting in January 2026, the government will negotiate prices for 10 high-cost drugs, with more added each year. The first batch includes drugs like Eliquis, Xarelto, and Jardiance. For people on Medicare, that means average savings of about $400 a year. But if you’re under 65 and on private insurance? You’re still stuck in the old system.Generic Drugs: The Secret Weapon You’re Not Using

Here’s the truth: generic drugs are almost always the same as brand names. Same active ingredient. Same FDA approval. Same effectiveness. The only difference? Price. Generics cost 80-85% less on average. Yet, many people still ask for the brand name because they think it’s better. It’s not. Take lisinopril. The brand name is Zestril. It costs $120 for a 30-day supply. The generic? $4. Same pill. Same results. Same side effects. Same doctor’s order. Yet, many pharmacies still default to the brand unless you specifically ask for the generic. You have to speak up. Even better: some pharmacies, like Walmart and Costco, sell a list of generics for $4 or less-no coupon needed. CVS, Walgreens, and Rite Aid have similar programs, but you have to check their websites. And if your doctor doesn’t mention generics? Ask. Say: “Is there a generic version? And if so, can you prescribe it?” Most doctors will say yes. They’re not trying to upsell you-they’re just used to writing the brand name.Coupons: Helpful or a Trap?

You’ve seen them: “Save $50 on your next Saxenda prescription!” “$0 copay with coupon!” They look like free money. And sometimes, they are. But here’s the catch: these coupons are almost always offered by drugmakers to push you toward their brand-name drug. That’s fine if you’re uninsured or underinsured. But if you have insurance, the coupon often doesn’t apply to your copay. Instead, it reduces the amount your insurer pays. That means your insurer might raise your premiums next year to make up for the discount. And worse: if you’re on Medicare Part D, using a manufacturer coupon can actually push you into the coverage gap faster-because the coupon counts as your out-of-pocket spending. That’s right. A $50 coupon might make your bill look lower today, but it could cost you hundreds later. The only safe coupons are those from GoodRx or SingleCare. These aren’t manufacturer coupons. They’re discount cards that work like cash at the pharmacy. You don’t need insurance. You don’t need to sign up. Just show the barcode. For many generics, you’ll pay less than $5. For some brand drugs, you’ll pay half price. And it doesn’t mess with your insurance plan.

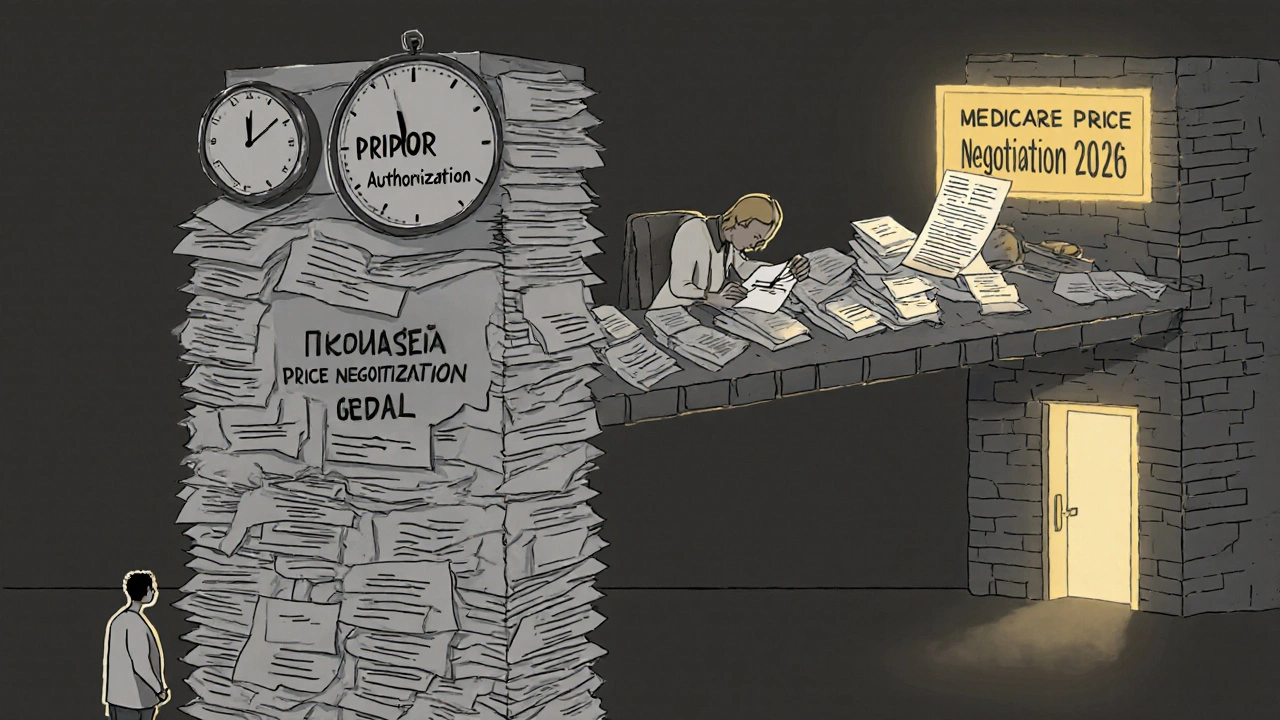

Prior Authorization: The Bureaucratic Wall

You’ve got your prescription. You’ve got your coupon. You’re ready to pay. Then the pharmacist says: “We need prior authorization.” That means your insurance company doesn’t automatically approve this drug. They want proof it’s “medically necessary.” Your doctor has to fill out forms. You might have to wait days. Or weeks. And if they deny it? You’re stuck. No drug. No refills. No exceptions. Prior authorization is used to control costs. But it’s not always about safety. Sometimes, it’s just because your insurer prefers a cheaper drug-even if your doctor says it won’t work for you. For example, if you’re on a GLP-1 weight-loss drug like Ozempic, your insurer might force you to try three cheaper diabetes pills first. Even if you don’t have diabetes. Even if those pills gave you nausea and headaches. The good news? You can fight back. Ask your doctor to write a letter of medical necessity. Call your insurer’s appeals line. Keep records. And if you’re on Medicaid or Medicare, you have stronger rights. Some states have laws limiting how long insurers can delay prior authorizations. In Minnesota, they must respond within 72 hours for urgent cases. In others? It’s a mess.What You Can Do Right Now

You don’t have to wait for Congress to fix this. Here’s what works today:- Always ask for the generic. Even if your doctor doesn’t suggest it.

- Use GoodRx or SingleCare. Compare prices at three pharmacies before you pay.

- Don’t use manufacturer coupons if you’re on Medicare. They can hurt you later.

- Ask your doctor to file the prior auth request immediately. Don’t wait until your script runs out.

- Check if your pharmacy offers a $4 generic list. Walmart, Costco, and Target do.

- Call your insurer. Ask: “What’s the lowest-cost alternative on your formulary?”

The Bigger Picture

The system is broken. But it’s not hopeless. The $2,000 out-of-pocket cap for Medicare Part D in 2025? That’s huge. It means no more “coverage gap” where you pay everything. No more $1,000 bills for insulin in December. And the GENEROUS Model for Medicaid? It’s testing whether we can link U.S. drug prices to what other countries pay. Canada, Germany, and the UK pay far less for the same drugs. Why can’t we? Some drugmakers are starting to offer flat-rate pricing. Mark Cuban’s Cost-Plus Drugs sells 300+ medications at cost plus 15%. No middlemen. No rebates. No confusion. You pay $10 for metformin. Not $120. Change is coming. Slowly. But you don’t have to wait. The tools are already here. You just need to use them.Frequently Asked Questions

Are generic drugs really as good as brand-name drugs?

Yes. Generic drugs must meet the same FDA standards as brand-name drugs. They contain the same active ingredient, work the same way, and have the same risks and benefits. The only differences are inactive ingredients (like fillers) and packaging. Studies show generics work just as well in real-world use. If your doctor says otherwise, ask for the evidence.

Can I use a manufacturer coupon with my Medicare Part D plan?

Technically, yes-but it’s risky. Manufacturer coupons count toward your out-of-pocket spending under Medicare Part D. That means they can push you into the coverage gap faster, making your next refill more expensive. They also don’t reduce your monthly premium. For Medicare users, GoodRx or pharmacy discount programs are safer and often cheaper.

Why does my prescription cost more at one pharmacy than another?

Because pharmacies don’t all pay the same price for the same drug. Insurance plans negotiate different rates with different pharmacies. Some pharmacies get bulk discounts. Others get rebates from PBMs. That’s why a $100 drug might cost $60 at Walmart and $130 at Walgreens. Always compare prices using GoodRx before you pay.

What if my insurance denies my prior authorization?

You can appeal. Start by asking your doctor to write a letter explaining why the drug is medically necessary. Then call your insurer’s appeals line. Keep a log of every call: date, name, what was said. Many denials are overturned on appeal, especially if you have documentation from your doctor. Don’t give up after the first no.

Is there a way to get my meds for free?

Some drugmakers offer patient assistance programs if you meet income limits. You can apply through NeedyMeds.org or the Partnership for Prescription Assistance. These aren’t coupons-they’re free or low-cost drugs directly from the manufacturer. You’ll need to submit proof of income and your prescription. It takes time, but it works for people who qualify.

How do I know if my drug is eligible for Medicare price negotiation?

The first 10 drugs under Medicare negotiation were announced in August 2024 and take effect in January 2026. They include Eliquis, Xarelto, Jardiance, Farxiga, and others. You can find the full list on the CMS website. If your drug is on it, your out-of-pocket cost will drop significantly. If not, it could be added in future years-up to 20 drugs per year starting in 2027.

Next Steps

If you’re paying more than $50 a month for a single prescription, you’re likely overpaying. Take 10 minutes today to:- Check your drug on GoodRx.com.

- Call your pharmacy and ask for the cash price.

- Ask your doctor: “Is there a generic version?”

- Write down your prior auth status-did they approve it? When does it expire?

mike tallent

November 17, 2025 AT 06:13Just used GoodRx for my metformin - paid $3.50 at Walmart. My old copay was $45. 🤯 I didn’t even know this was a thing until last month. Seriously, if you’re paying more than $10 for a generic, you’re doing it wrong. Save your cash for something that actually matters - like pizza or gas. 🍕⛽

Joyce Genon

November 17, 2025 AT 21:55Look, I get it - you’re all excited about generics and coupons like they’re some kind of magic solution. But let’s be real. The system is rigged. PBMs, insurers, drugmakers - they’re all playing 4D chess while we’re stuck trying to figure out why our insulin costs more than our rent. And now you want us to ‘just ask for the generic’? Like the doctor even knows what’s on the formulary? They’re just copying and pasting from their template. This whole ‘take control’ advice is just corporate gaslighting wrapped in a Walmart bag.

John Wayne

November 18, 2025 AT 05:07Generics are not ‘just as good.’ They’re bioequivalent under lab conditions. Real-world pharmacokinetics? Not always. I’ve seen patients have adverse reactions to generic formulations due to inactive ingredients. And don’t get me started on the quality variance between Indian and domestic manufacturers. The FDA’s oversight is laughable. This isn’t empowerment - it’s negligence dressed up as a budget hack.

Julie Roe

November 20, 2025 AT 01:38Hey, I know how overwhelming this all feels. I’ve been there - standing in the pharmacy with a prescription in hand, heart pounding because I can’t afford it. But please, don’t give up. Start small. Go to GoodRx. Type in your drug. Look at the cash prices. Call three pharmacies. Even if you only save $15 this month, that’s $180 a year you didn’t lose. And if your doctor doesn’t mention generics, just say, ‘Hey, I’m trying to keep costs down - is there a generic?’ Most of them will say yes. You’re not being difficult. You’re being smart. And you deserve to be healthy without going broke.

jalyssa chea

November 20, 2025 AT 11:24why do they even make us jump through all these hoops like prior auth its insane i had to wait 3 weeks for my adderall last year and my doctor had to call like 5 times and still they denied it at first like what even is this system im not a statistic im a person who needs this med to function and they treat you like a criminal

Gary Lam

November 20, 2025 AT 15:29So let me get this straight - we’re supposed to be grateful that Medicare’s finally negotiating prices… but only for 10 drugs, starting in 2026? Meanwhile, I’m paying $120 for a 30-day supply of a drug that costs $10 to make? And you’re telling me to use GoodRx like it’s some kind of revolutionary act? Bro. It’s 2025. We’ve got AI that writes poems and self-driving cars. But I still can’t buy my blood pressure med without a second mortgage. This isn’t a system. It’s a joke with a pharmacy receipt.

Peter Stephen .O

November 21, 2025 AT 02:25Y’all are missing the forest for the trees. Yes, GoodRx saves you $40 on lisinopril. Yes, generics are legit. But the real win? Knowing your rights. If your insurer denies prior auth? Fight back. Write a letter. Call the appeals line. Keep records. And if you’re on Medicaid? You’ve got more leverage than you think. I helped my aunt get her Ozempic approved after 6 weeks of nonsense - she’s lost 30 lbs and finally sleeps at night. It’s not about hacking the system. It’s about demanding dignity. You’re not a bill. You’re a human. And you deserve to breathe without worrying about your next pill.

Andrew Cairney

November 22, 2025 AT 15:49EVERYTHING you just said is a distraction. The real reason drugs cost so much? The government is in bed with Big Pharma. The FDA? Controlled. The PBMs? A front. Even GoodRx? Probably funded by pharma to keep you distracted while they raise prices 20% every year. And don’t even get me started on how insulin was once cheap - then the patents got extended by shady lobbying. This isn’t capitalism. It’s a cartel. And they’re watching you right now. 👁️🗨️

Rob Goldstein

November 23, 2025 AT 12:14Let’s clarify a few key clinical and administrative points. The 80-85% cost differential for generics is well-documented in the JAMA Health Forum and CMS datasets. However, bioequivalence thresholds (80-125% AUC) don’t guarantee identical therapeutic outcomes in polypharmacy patients, especially those with renal or hepatic impairment. Additionally, prior authorization timelines vary by payer type: commercial plans average 4.7 days, Medicaid 3.2, Medicare Advantage 5.9. The $4 generic programs are viable under the 340B program, but only at qualifying entities. Always verify your pharmacy’s 340B status. And for Medicare Part D users - manufacturer coupons do count toward the out-of-pocket threshold, which can accelerate entry into the coverage gap. Strategic use of SingleCare, which operates outside payer networks, is indeed optimal for non-Medicare beneficiaries.

vinod mali

November 24, 2025 AT 07:36in india we pay $1 for metformin. no coupons. no apps. just pharmacy. i know its different here but still… why is this so hard in usa? i moved here 2 years ago and i still cry every time i see a pill bottle price. you guys have so much. why does health cost so much?

Jennie Zhu

November 25, 2025 AT 01:15It is imperative to underscore that the utilization of manufacturer-sponsored coupons within the context of Medicare Part D may inadvertently compromise the beneficiary’s financial trajectory by accelerating progression into the coverage gap, thereby increasing long-term liability. Moreover, the structural inefficiencies inherent in the Pharmacy Benefit Manager (PBM) reimbursement model are not amenable to individual-level interventions. Systemic reform, grounded in evidence-based policy and price transparency mandates, remains the only viable pathway toward equitable pharmaceutical access.

Kathy Grant

November 25, 2025 AT 14:49I just want to say… I’ve been on 7 different meds in the last 5 years. Some saved my life. Others made me feel like a lab rat. I used to think if I just tried harder, if I just asked nicer, if I just waited longer - things would get better. But they didn’t. Not until I stopped apologizing for needing help. Not until I started calling my insurer every Monday like clockwork. Not until I told my doctor, ‘I can’t afford this. What’s the cheapest thing that still works?’ And guess what? He looked me in the eye and said, ‘You’re right. I’m sorry.’ That moment? That was healing. You’re not broken for needing help. You’re brave for asking. And you’re not alone. I’m right here with you.